Stock Market Timing Strategies: Are they all fake or what?

To be able to acquire as a contrarian, you want the ideal time and you need to put able at the proper size – knowing the stock market timing strategies. Should you do it too little, it is not significant. Should you do it too large, you can get wiped out if your time is slightly off.

There are lots of people who provide guidance, but few offering advice. — Anonymous Irrespective of whatever the specialists say, an individual shouldn’t fight with the Fed, for if you personally, you find yourself dead. Dead as in dead broke. Losing your mind in a crisis is a fantastic way to turn into a catastrophe. — C.J. Redwine “the opportunity to get is when there’s blood in the streets” — Baron Rothschild

The procedure requires courage, dedication and an understanding of your own psychology. — Michael Steinhardt Before we move we believe these crucial sayings could assist you to fine-tune their market timing plans, for they provide invaluable insights into the mindset of players which were ahead of their days.

Stock Market Timing strategies: Crowd Psychology should play an integral part

People are vulnerable to herd since it’s always warmer and warmer at the centre of the herd. Really, our brains have been wired to make us social creatures. We feel that the pain of social exclusion in the very same areas of the mind where we feel real physical pain.

Being a contrarian is a bit like getting your arm broken on a regular basis. — James Montier These wise men that felt smart by hammering the hell out of us throughout the industry collapse will weep tears of blood soon if they’re not yet doing this. They made the exact same mistake earlier, promising to not fall for the imitation news/hysteria which compelled them to dump their stocks at the base. However, like mentally deranged people, they did exactly the exact same thing at the worst possible moment, and what had been their explanation; “it is different now”.

Well, it is going to differ, and that is the reason why the masses may use indefinitely to justify how they let emotion overrule logic and marketed when they ought to have been purchasing. In the long run, this story is going to be repeated over and over, since the mass mindset knows no greater. Therefore the saying misery enjoys company and stupidity simply needs it. Success relies on taking a strategy that’s likely to draw cries of criticism against the masses. The only expression that comes to mind is that the truth hurts and boy does it.

One of the Best Market Timing Strategists

- 150 basis point decrease in prices

- $700 billion bailout package

- Another two trillion-plus bailout package

- two billion bucks increased from the markets from the Fed to offer liquidity

- Today the Fed has said that they’ll inject as much cash as they see fit. To Put It Differently, the Feds are publicly admitting to permanently Q.E.

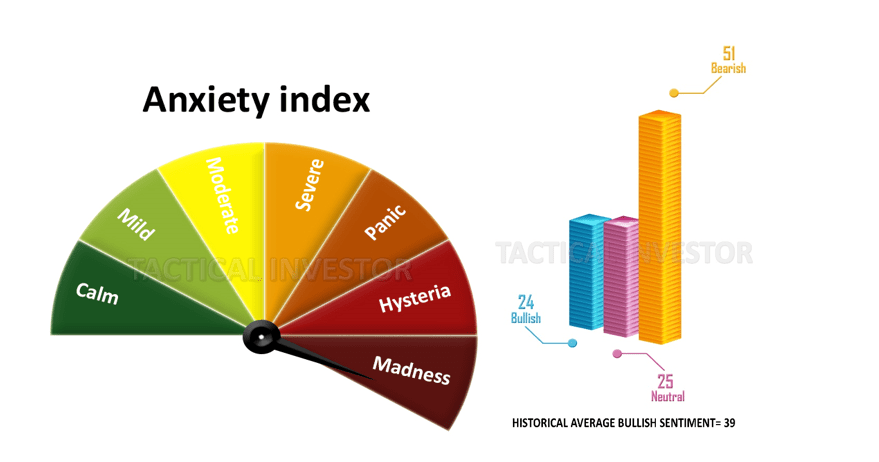

The people continue to be worried, so the game plan is easy. Panic ought to be seen as the code phrase for purchasing. Hence, once the masses fear and sell their stocks jump in and purchase and keep doing so until the tendency turns negative. Michael Levitt, a Nobel laureate and Stanford biophysicist, started analyzing the amount of COVID-19 cases globally in January and properly calculated that China would undergo the worst of its own coronavirus outbreak extended before several health experts had predicted.

If you would like to rob a guy you, the ideal means is to polarise those around him. If you are going to steal in the masses for a long time ahead, the ideal strategy is to induce a condition of helplessness via hysteria. Have a step back and examine how readily the audience is allowing congress to rob them for a long time to come. There could have been no chance in hell that one of these bundles would have had some chance of being accepted three weeks past.

The biophysicist that called the path that the virus could take in China is calling a similar result for the remainder of the planet. He accurately predicted the result that went contrary to what all of the other false prophets of doom have been laying outside. Market Timing approaches: Volume Psychology should play a key part It is not always easy to do what is popular, but that is where you earn your cash. Purchase stocks which appear bad to less cautious investors hang on till their actual worth is recognized. I have never purchased a stock unless, in my opinion, it was available. Purchase on the cannons and market on the trumpets. — John Neff I will say the way you can become wealthy…Be fearful when others are greedy.

Be greedy when others are fearful. — Warren Buffett When the trend is upward, strategic investors must see fear through a bullish lens. Purchase when the masses dread and sell when they’re jumping up with pleasure.

These quotations from some brilliant people exemplify the worth of maintaining a cool head during times of fear. Sooner or later comes a crisis in our affairs, and the way we fulfil it decides our future success and happiness. Since the start of time, every kind of life was called on to fulfil such a catastrophe. — Robert Collier When many epidemiologists are warning of months, or years, of enormous social disruption and countless deaths, Levitt states the data just don’t support such a dire situation — particularly in locations where moderate social distancing measures have been set up.

Among the Very Best Market Timing Strategists Rather than creating a stir fry, the masses are demanding the Fed do longer. To put it differently, they are now begging the authorities to produce more income from thin air because the image seems to have shifted. All of a sudden their disagreements that too much cash could be awful for the machine are no longer a problem, for they’re just concerned with enhancing the prognosis now.

They’ll rue the day they gave their authorities so much electricity, hence the expression, the ones who don’t learn from history are doomed to repeat it. Just don’t forget before you say you wish more individuals were/are brighter, imagine how much tougher it will be for you to browse if those around you’re as eloquent as you are. In the long run, be thankful for the morons of this world for they provide investors with invaluable data which may be utilized to boost the net worth and remain out of harm’s way. In addition, this data shows what we’ve always said, that no fantastic deed goes unpunished and a good Samaritan generally ends up as a lifeless Samaritan. Never provide to help somebody that doesn’t seek it for they will probably show up you the closest pole should you do that.

— Saying’s that Might Help fine-tune market timing plans

Successful men and women recognize crisis as a time for a change — from smaller to greater, smaller to larger. — Edwin Louis Cole

To buy when others are despondently selling and to sell when others are euphorically purchasing takes the best courage, but supplies the best profit. Bull markets are created in pessimism, grow on scepticism, mature on optimism and die on euphoria. The time of maximum pessimism is the ideal time to purchase, and the period of maximum optimism is the ideal time to market. If you would like a better performance compared to the audience, you have to do things differently in the audience. — Sir John Templeton “What we want is to control the anxiety,” he explained. In the grand strategy, “we are going to be nice.”

And that’s what we all must concentrate on, for in the grand scheme of things we’re going to be fine since there isn’t 1 bit of information that signifies that the gloom and doom scenarios being depicted have some chance of passing. What astute investors will need to concentrate on is your chance factor, for this is precisely what the ultra-wealthy and insiders do. Insiders wouldn’t be financing the truck and loading up whenever they believed the world would end. This really is a classic instance of this boy who cried wolf on many occasions.

To be successful as a contrarian, you need to recognize what the audience considers, have a concrete explanation for why the majority isn’t right, and also have the patience and certainty to stay to that which is, by definition, an unpopular bet. — Whitney Tilson

Panic is one of the Major market timing strategies when used properly

He foresees a similar result in the USA and the rest of the planet.

Other Articles of Interest

Is withholding information manipulation?

How do I know my socioeconomic status?

How did the stock market panic 2020 reshape investor strategies?

Could the stock market panic of 1907 happen again?

How does the stock market trend after election affect investments?

How did the GameStop saga of 2021 reshape the stock market?