In an era where information overflows, and opinions are a dime a dozen, the contrarian stance stands out as a lighthouse of originality and a driver of progress. Contrarianism isn’t just about going against the grain; it’s about a thoughtful rejection of the mainstream, a choice to view the world differently. This article will take you through the sophisticated art of contrarian thinking, showing you how this approach is not merely a rebellious act but a strategic, insightful way to navigate a complex world.

The Contrarian’s Creed: Challenging the Status Quo

Contrarianism is the intellectual art of challenging the norm and seeking new perspectives. Adopting a contrarian mindset is critically assessing the masses’ direction and, more often than not, walking a different path. This isn’t about opposition for its own sake; it’s about believing in the power of an alternative viewpoint. This mindset catalyzes innovation when harnessed correctly, pushing us into unexplored territories and sparking groundbreaking ideas.

However, the path of the contrarian is lined with risks as accurate as the rewards. Standing alone can mean facing criticism and isolation. A contrarian approach can be challenging in the financial markets, where collective sentiment can dominate. Yet, contrarians can shine in these markets, pinpointing opportunities that the majority overlooks.

The Contrarian and Economic Tides: Seeing Beyond the Waves

The Federal Reserve plays a pivotal role in America’s economic stability, with its monetary policies shaping interest rates and liquidity. These policies can inadvertently create boom-bust cycles, periods of economic expansion followed by contraction, leading to downturns or recessions.

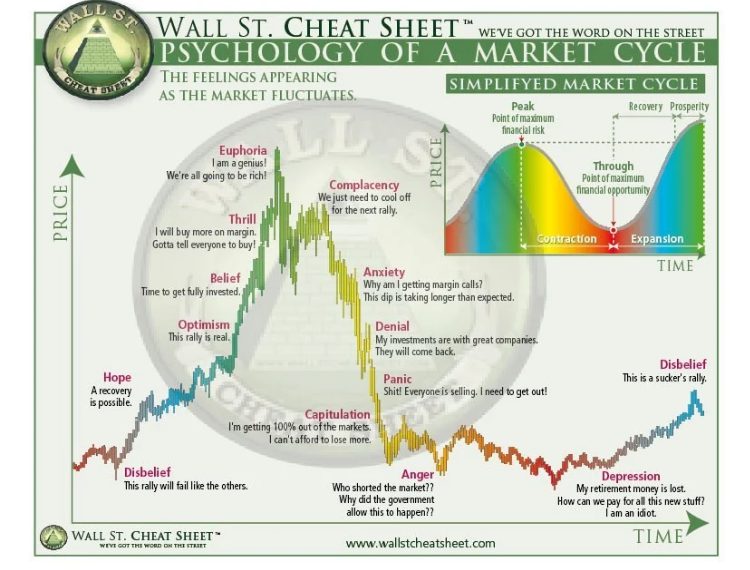

A contrarian, armed with an understanding of the Federal Reserve’s influence, may interpret these cycles differently from the mainstream narrative. While many investors surf the wave of economic booms, contrarians might anticipate the coming bust. They could adopt a defensive investment strategy, bracing for the downturn, or position themselves to profit from a market correction.

The Contrarian Versus the Herd: The Art of Strategic Dissent

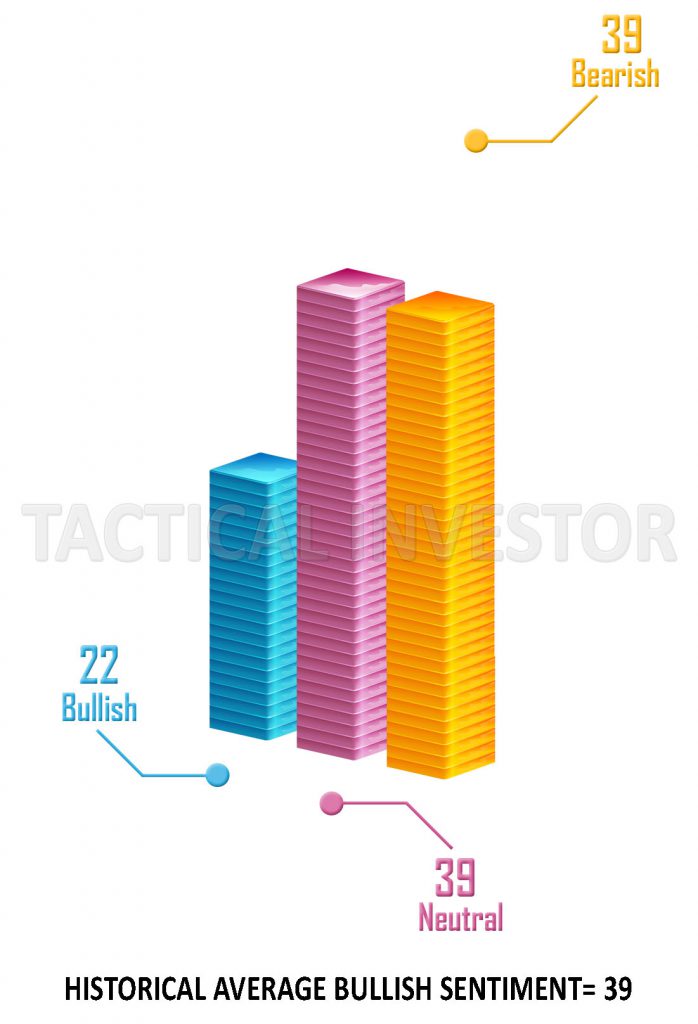

The bandwagon effect and herd mentality are potent forces in the investment world. Collective rushes toward or away from investments create trends that can become self-fulfilling prophecies. Herd behaviour, often driven by mob psychology, can overshadow individual decision-making. The contrarian investor, however, is attuned to these dynamics and aims to capitalize on them.

By observing the herd carefully, the contrarian spots potential market overreactions—undervalued or overvalued assets due to the crowd’s influence. Here lies the essence of elegant dissent, where the contrarian must balance opposition to the crowd with wise investment choices that mitigate risk and target long-term gains.

Contrarianism stands as a symphony of intellectual defiance, a testament to the power of independent thought in a world often dominated by the echo of consensus. The finesse with which one practices this art can turn the tides of fortunes and shape the contours of progress. It serves as a compelling reminder that sometimes the most profound insights emerge not from the crowd’s roar but from the quiet corner of critical challenge.

Contrarianism in the Modern Market: A Fresh Perspective

In the fast-paced world of finance and technology, contrarianism remains a potent strategy, yet the tools and context have evolved dramatically. This section will undergo a thorough update to reflect the latest analytical tools that support the contrarian investor’s decisions in today’s markets.

Technical Analysis Revisited: The Contrarian’s Enhanced Toolkit

While the core of contrarianism is a mindset, its effectiveness is often bolstered by state-of-the-art technical analysis tools. These tools have advanced significantly, with machine learning algorithms and complex predictive models joining the ranks of traditional indicators like oscillators, Moving Average Convergence Divergence (MACD), and the Relative Strength Index (RSI).

Today’s oscillators are more sophisticated, integrating real-time data and predictive analytics to gauge market sentiment more precisely. MACD and RSI have been refined to work alongside new indicators that account for the complexities of modern trading environments, including cryptocurrency volatility and global economic shifts. These enhancements empower the contrarian to make more informed decisions that defy mainstream market sentiment.

Historical Insights: Learning from Contrarian Legends

History is a treasure trove of contrarian wisdom, with figures who have reshaped entire fields with unorthodox views. The Renaissance, for example, was a seismic shift in thought led by contrarians like Galileo, who dared to defy the status quo. Their courage laid the foundations for centuries of scientific advancement.

In finance, we’ve seen contrarians navigate through bubbles and crashes with proactive strategies that have stood the test of time. From the South Sea Bubble to the dot-com bubble and even the 2008 financial crisis, contrarian investors have demonstrated the timeless value of going against the tide when it’s backed by rigorous analysis and deep understanding.

The Refined Art of Contrarianism: Striking the Right Balance

Contrarianism is not merely about opposition but the graceful execution of an alternative vision. It’s a delicate dance of timing, insight, and discipline. Today, the contrarian investor doesn’t just reject popular opinion on a whim but does so with a calculated approach informed by a wealth of data and a disciplined methodology.

In the investment landscape, this approach can lead to substantial rewards. Contrarian strategies often involve identifying undervalued assets dismissed by the market or capitalizing on overvalued assets caught in speculative frenzies. The true elegance of contrarianism lies in knowing when to diverge from the herd and having the patience to wait for the market to recognize the actual value of an investment.

Other Articles of Interest

Mastering the Sophistication of Successful Investing Money Management

What is the equation for finding the cost of preferred stock?

Elevate Your Investing Game with the Prestigious Benjamin Graham Stock Screener

Navigating the Intricacies: What is Return on Investment and Risk

Revolutionize Your Investments with the Innovative Synthetic Risk and Reward Indicator

The Exquisite Choreography of Tactical Asset Allocation in the Face of Regime Shifts