Investing is Like Watching Paint Dry: The Classy Way to Build Your Financial Empire

Investing can seem like a daunting task, especially for those who are new to the game. It’s often compared to watching paint dry – slow, tedious, and seemingly uneventful. However, just like the satisfying result of a freshly painted room, investing can lead to a beautiful financial future if done right. In this article, we’ll explore how the “watching paint dry” approach to investing can help you build your financial empire with class and sophistication.

“investing is like watching paint dry” may initially appear uninspiring, but it encapsulates the essence of a successful long-term investment strategy. Much like painting a room, investing requires careful preparation, patience, and attention to detail. It’s not about chasing quick gains or making impulsive decisions based on market fluctuations. Instead, it’s about creating a solid foundation and allowing your investments to grow steadily.

Consider the story of John Bogle, the founder of The Vanguard Group. Bogle pioneered the concept of index investing, which involves investing in a broad market index rather than trying to pick individual stocks. This approach, often called “passive investing,” embodies the “watching paint dry” mentality. By investing in a diverse range of companies and holding those investments for the long term, Bogle’s strategy allowed investors to benefit from the market’s overall growth without the stress and volatility of active trading.

In fact, a study by Dalbar Inc. found that over 20 years ending in 2020, the average investor underperformed the S&P 500 index by nearly two percentage points per year. This underperformance can be attributed to investors’ tendency to make emotional decisions, such as selling during market downturns or chasing hot stocks. By embracing the “watching paint dry” approach and staying the course, investors can avoid these common pitfalls and achieve better long-term results.

Of course, this doesn’t mean investing should be completely passive. Like painting a room requires occasional touch-ups and maintenance, a successful investment strategy requires regular review and adjustment. This may involve rebalancing your portfolio to maintain your desired asset allocation or making strategic changes based on shifts in the economic landscape. However, these adjustments should be made thoughtfully and with a long-term perspective rather than reacting to short-term market noise.

The Power of Patience

One of the key traits of successful investors is patience. Just like watching paint dry, investing requires a long-term perspective and the ability to resist the urge to make impulsive decisions. Warren Buffett, one of the most renowned investors of all time, once said, “The stock market is a device for transferring money from the impatient to the patient.” By embracing the “watching paint dry” mentality, you can avoid the pitfalls of short-term thinking and focus on the bigger picture.

According to a study by Fidelity Investments, investors who held onto their investments for at least 15 years saw an average annual return of 9.9%, compared to just 5.2% for those who held for less than five years. This highlights the importance of staying the course and letting your investments grow over time.

The Art of Diversification

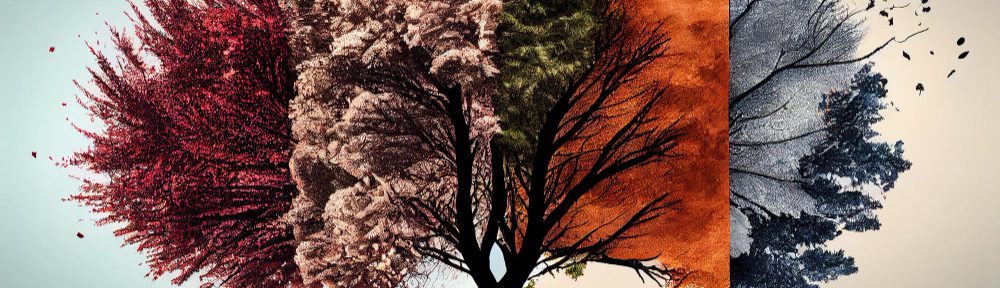

Another crucial aspect of successful investing is diversification. Just like a beautifully painted room requires a variety of colours and textures, a well-rounded investment portfolio should include a mix of different asset classes and sectors. You can minimise risk and maximise potential returns by spreading your investments across stocks, bonds, real estate, and other assets.

As financial expert David Bach puts it, “The key to building wealth is to diversify your investments and to start early.” By embracing the “watching paint dry” approach and diversifying your portfolio, you can create a stable foundation for your financial future.

The Beauty of Compound Interest

Compound interest is one of the most powerful tools in an investor’s arsenal. This is the process by which your investments earn interest not only on the initial principal but also on the accumulated interest from previous periods. Over time, this can lead to significant growth in your portfolio.

Albert Einstein famously called compound interest “the eighth wonder of the world,” and for good reason. According to a study by Vanguard, a $10,000 investment with an average annual return of 6% would grow to over $100,000 in just 30 years, thanks to the power of compound interest. By embracing the “watching paint dry” mentality and letting your investments grow over time, you can harness the beauty of compound interest and watch your wealth flourish.

The Importance of Education

Just like a skilled painter needs to understand the nuances of colour theory and brush techniques, a successful investor needs to educate themselves on the intricacies of the financial world. By learning about different investment strategies, market trends, and financial concepts, you can make informed decisions and avoid costly mistakes.

As financial educator Robert Kiyosaki notes, “The most successful people in life are the ones who ask questions. They’re always learning. They’re always growing. They’re always pushing.” By embracing a lifelong learning approach to investing, you can stay ahead of the curve and adapt to changing market conditions.

The Elegance of Simplicity

Finally, the “watching paint dry” approach to investing is all about embracing simplicity. Just like a minimalist painting can convey a powerful message, a streamlined investment strategy can lead to long-term success. By focusing on a few key principles – patience, diversification, compound interest, and education – you can build a solid foundation for your financial future.

As legendary investor Peter Lynch once said, “The simpler it is, the better I like it.” By keeping your investment strategy simple, you can avoid the pitfalls of over-complication and stay focused on your long-term goals.

Conclusion

Investing may seem like watching paint dry, but it’s a classy and sophisticated way to build your financial empire. By embracing patience, diversification, compound interest, education, and simplicity, you can create a beautiful masterpiece of wealth that will stand the test of time. So sit back, relax, and enjoy the process – your future self will thank you.

Discover Valuable Articles for Your Interests

Blackrock geopolitical risk dashboard

Harnessing the Positive Divergence Vector Field

What Is Normalcy Bias Hiding from Smart Traders?

JetBlue Carl Icahn’s High-Stakes Airline Gambit

The Greater Fool Theory Newsroom: Illuminating Financial Fallacies

Steven Fiorillo Dividend Harvesting: Revolutionizing Portfolio Growth